GATHER

Our process of securely collecting of health care claims (837), ERA (835) and medical plan contractual information.

AUDIT

Our advanced analytical technology is designed to efficiently align gathered information to find errors in underpayments or overpayments.

RECOVER

Working with providers and payors to reconcile errand claims and recover assets. The end result…Our technology achieves, on average, a 10:1 recovery over cost.

Gathering Claim Data

Secure and Compliant Data Exchange

Priority Number One

Using advanced encryption methods and hardened systems makes HIPAA-regulated data remain locked down throughout our solution.

PAX AuditBI

Behold!

The Power of Business Intelligence

Our highly scalable solution delivers the ultimate in business intelligence in processing historical or real time claims

GET STARTED NOWThe Perfect Audit Trifecta

Full alignment of the Claims to the Payment Advices to the Contractual Agreement.

GET STARTED NOWJoin us! It will only take a minute

Our Management Team

There are number of instructions to be followed at the time of refilling an inket cartridge. So whenever your printer ink runs dry you need to follow the below steps for inkjet cartridge refill.

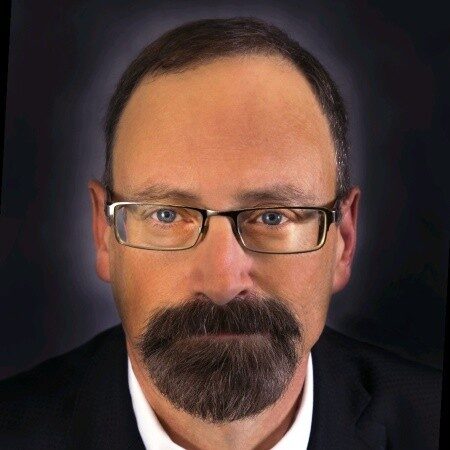

Mark Bodnar

Founder and Chief Executive Officer

Michael Hollar, CPA

Chief Financial Officer

Rick Sanford

Chief Information Officer